Commercial

A 2022 Economic Outlook Survey reveals a strong rise in business confidence, despite challenges

.

Jul. 12, 2022

Business and economic confidence

Business change in 2022 versus 2021

| Business change in 2022 versus 2021 | Decrease | Remain the same | Increase |

|---|---|---|---|

| Price of your good/services | 2% | 32% | 66% |

| Real Business Activity – volume, not dollar revenue | 10% | 25% | 65% |

| Real Profits – inflation-adjusted profit | 17% | 27% | 56% |

| Financial investment in your business | 7% | 46% | 47% |

| Number of employees on payroll | 9% | 45% | 46% |

Economic and business confidence over next 12 months

Percentage = Very or extremely confident

| 2021 Outlook | 2022 Outlook | Change | |

|---|---|---|---|

| Your company | 50% | 65% | +15 |

| The local economy | 25 | 39 | +14 |

| The state economy | 24 | 36 | +12 |

| The US economy | 23 | 23 | -- |

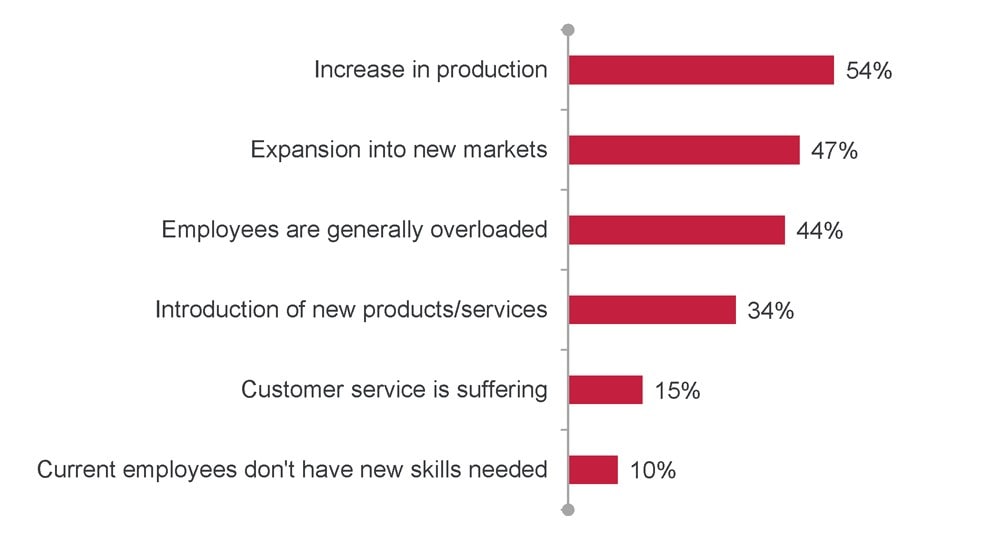

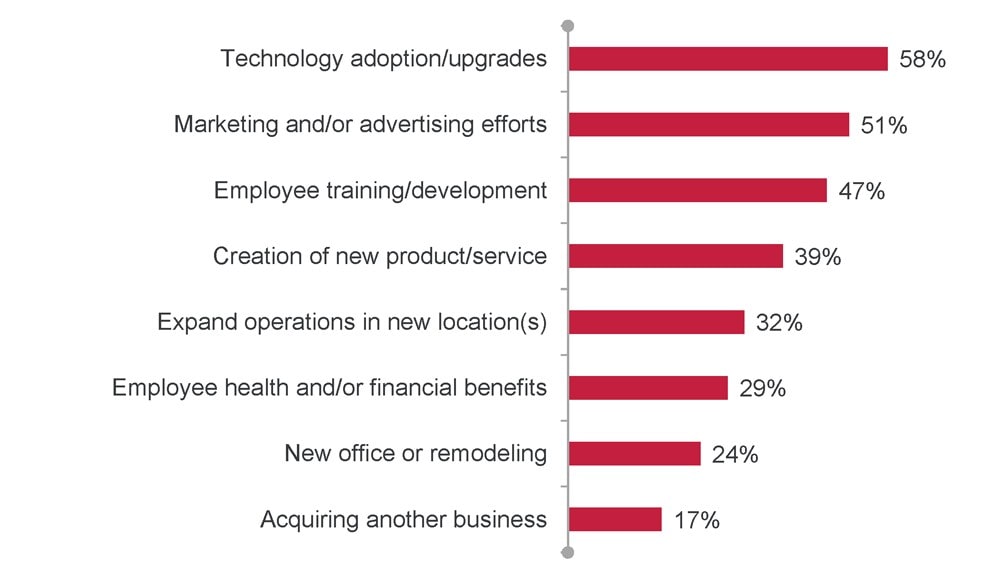

The hunt for talent

Rising costs and supply chain issues

How Covid-19 has impacted business

| 2021 Outlook | 2022 Outlook | Change | |

|---|---|---|---|

| Have had to find new ways to interact with clients and customers | 77% | 69% | -8 |

| Inability to travel | 68% | 58% | -10 |

| Introduction of remote working policies for employees | 55% | 50% | -5 |

| Disruptions to our supply chain | 34% | 49% | +15 |

| Delivery of our products and services | 39% | 40% | +1 |

| Needed to seek out financial assistance | 42% | 39% | -3 |

| Workforce changes | 42% | 34% | -8 |

| Required us to invest in new technologies | 36% | 33% | -3 |

| Modifications have been made to the office layout | 36% | 28% | -8 |

| Re-evaluated real estate needs | 26% | 26% | - - - |

| Cancelled or deferment of capital expenditures | 32% | 25% | -7 |

| Created liquidity or cash flow issues | 32% | 25% | -7 |

| Required us to find new revenue channels | 32% | 23% | -9 |

Read more from our 2022 Economic Outlook Survey in the local market reports published by The Business Journals in the markets referenced below:

- Atlanta Opens in a new window.

- Denver Opens in a new window.

- South Florida Opens in a new window.

- Boston Opens in a new window.

- Milwaukee Opens in a new window.

- St. Louis Opens in a new window.

- Chicago Opens in a new window.

- Minneapolis Opens in a new window.

- Tampa Opens in a new window.

- Dallas Opens in a new window.

- Pittsburgh Opens in a new window.

All loans and other extensions of credit are subject to prior approval. The CIBC logo is a registered trademark of CIBC, used under license. ©2022 CIBC Bank USA.