The auto industry is not without opportunity, despite the challenges it currently faces. That’s the main sentiment coming out of CIBC’s annual Automotive and Economic Outlook event. Here’s what the event speakers had to say about the 2022 and potential 2023 economic and automotive trends.

1. The U.S. economy is strong, but growth will slow into 2023

The U.S. economy has generally outperformed peer economies during the pandemic, as ample fiscal stimulus and less restrictive COVID measures on activity helped gross domestic product (GDP) surpass its pre-pandemic level in mid-2021. Higher interest rates as a result of inflationary pressure are likely to subdue that in 2023.

“The U.S. economy is strong relative to other countries,” said Katherine Judge, director and senior economist, CIBC Capital Markets. “Some of that is due to the fact that the U.S. economy is more inward looking and consumption-based. It’s also because the scale of government support direct to households was extremely large during the pandemic. All of that has resulted in the U.S. economy being a lot further ahead than many advanced economies.”

The U.S. economy was more resilient than expected during the Omicron wave in early 2022. However, the pace of growth in the first quarter looks to have slowed as exports and production for inventories were hindered by variant-related disruptions abroad.

Looking ahead to the second quarter, higher gasoline prices squeezing incomes will limit spending in discretionary categories, but Judge expects growth to accelerate in the summer months due to pent-up demand for services. There have been some tentative signs of a levelling-off in service activity lately as Omicron spreads, but that’s likely to represent an only temporary roadblock. Judge expects to see a solid 3.5% pace of GDP growth in the U.S. economy over 2022, while growth is expected to slow to 2.3% in 2023 as higher interest rates weigh on activity.

2. Supply chain challenges continue due to the war in Ukraine

Just when industry analysts gained a bit more clarity on labor and supply chain inventory and locked in their forecasts, Russia invaded Ukraine. The Russia-Ukraine conflict directly impacts the U.S. auto industry by creating new supply chain snarls and pushing up the price of gas to record highs domestically.1

Both Russia and Ukraine export oil, natural gas, neon, metals, grains and fertilizers. While these exports will not be stopped, supply will be reduced, leading to increased manufacturing costs.

“There’s not a lot of vehicle production going on in Ukraine, but they do build a lot of components,” noted Mike Wall, executive director of Automotive Analysis with S&P Global. “Palladium and nickel come from Russia. We get neon gas from both Ukraine and Russia. Shortages of these things can dramatically impact the input costs for vehicles. These things will inform our long-term production outlook.”

For auto manufacturers, a shortage of chips will continue to challenge production in the coming months. The average number of chips used in vehicle production has nearly doubled since 2017.2 However, the growing demand for electric vehicles and increasing demand for chips from other markets have reduced the number of chips available.

3. Affordability and availability: Ongoing concerns

Low inventory and higher interest rates have driven up costs and made it more expensive for consumers to purchase vehicles.

Will inventory improve in the coming year? Inventory levels will likely remain low through the end of 2022, given supply chain issues. Before the pandemic, U.S. inventory averaged 3.5 million units. Today, it’s around 1.2 million.3

“The question we get is, ‘When will we get back to normal?’” Wall said. “But my question back is, ‘What will normal look like?’ The short answer is somewhere between one and two million units. I think automakers are increasingly aware of the benefits of having a more rationalized inventory footprint.”

4. Industry forecasts downgraded as challenges linger

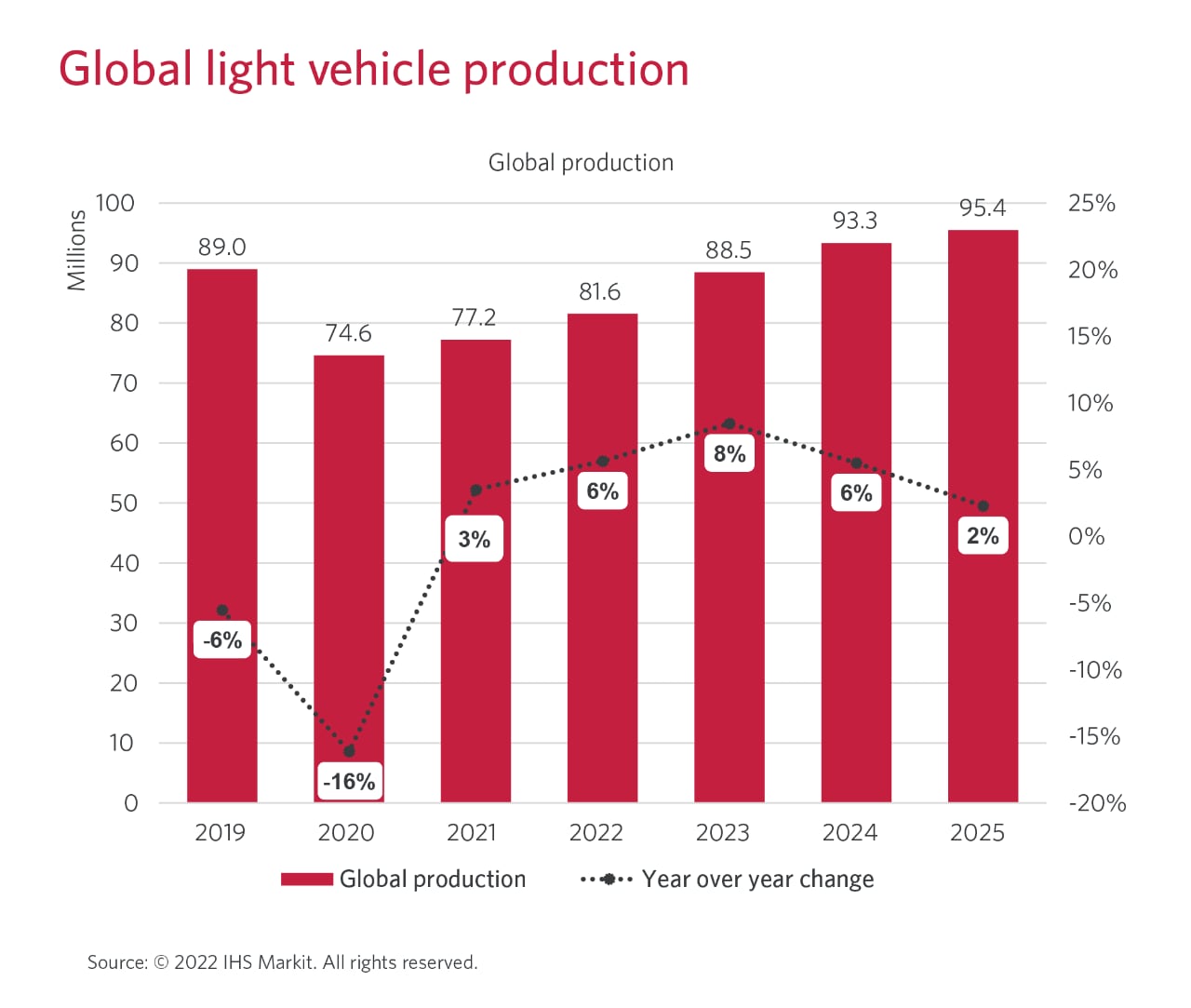

Light vehicle sales are projected to be around 81.6 million globally in 2022, well below their pre-pandemic highs of 94 million in 2017 and 2018. However, that number is projected to grow to 88.5 million in 2023 as commodity supply normalizes and prices retreat.4